Envisioning is an independent technology research foundation based in Brazil. We have a mission: to raise the level of global understanding about the implications of accelerating change. We conduct ongoing research on emerging tech using a combination of methodology, technology and design.

Our report on the future of money is the first in a series of explorations on the future of global systems including industries, sectors and economies. Starting our research on the technology of money is a matter of timing: we believe an industry-toppling disruption is underway. Think Napster, but bigger.

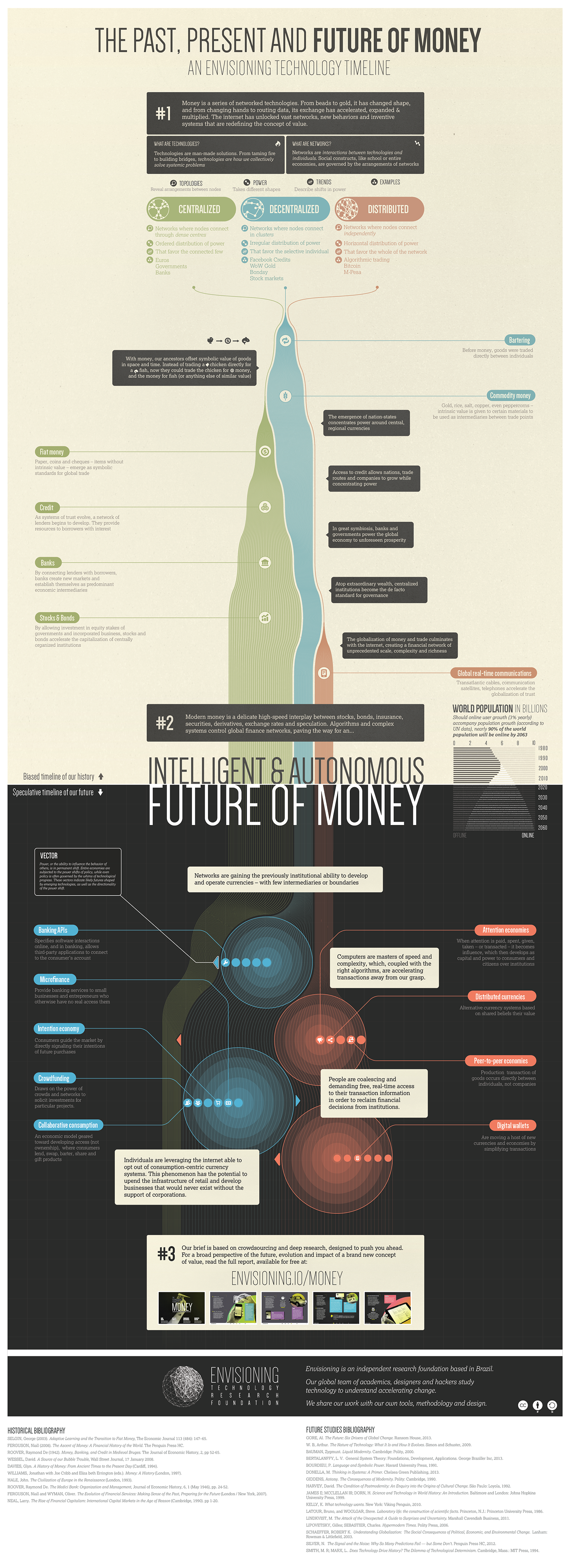

Indeed, money is a technology hiding in plain sight. As a human invention, it is no different than passports, agriculture or space flight, and like networks and computers, it obeys the same accelerating laws (⤴ ). From beads to gold, money has changed shape and from changing hands to routing data, the exchange of money has accelerated, expanded & multiplied.

Today, this ancient technology is transforming society’s concept of power and how it is held.

Governments are facing coalescing citizens and the financial industry is perpetually covering its ass. yet, technologies and their communities have flourished as digitized money flows freely through their networks. Internet-born currencies, network-only banks and HFT algorithms have become state-less and owner-less agents operating at breakneck speeds with no regard to existing laws or powers. The playing field is not only leveling, it is changing.

In the following pages, we will explain how technological power shifts observed in other economies are likely to shape the nature of money. We have devised a framework divided between institutions, individuals and networks, indicating the individual technologies that are enabling power to be shifted between previously siloed structures. Our fractured financial landscape shows no sign of moving to a state of more order.

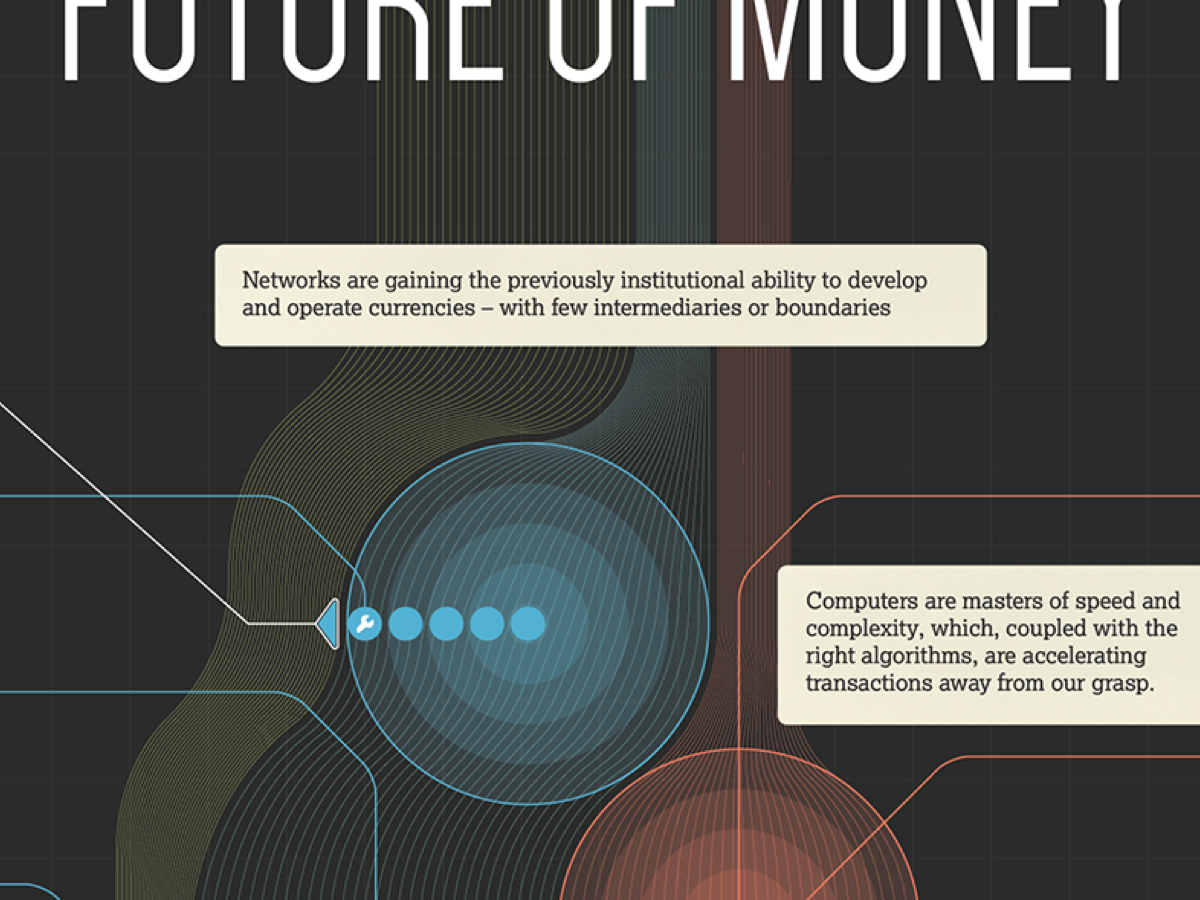

People are coalescing and demanding free, real-time access to their transaction information in order to take charge of their financial decisions away from institutions. Individuals are leveraging the internet and trust are able to opt out of currency systems and consumption-centric currencies. Networks are gaining the previously institutional ability to develop and operate currencies on a global scale. Computers are inherent masters of speed and complexity, which coupled with the right algorithms, accelerate transactions away from our grasp.

These power shifts are well underway.

Banks and Governments know they are losing their grip on customers and citizens. Technology shows no sign of slowing down, leaving us perpetually future-shocked trying to grapple with narrower slices of understanding. This report is our best attempt at explaining what is going on.